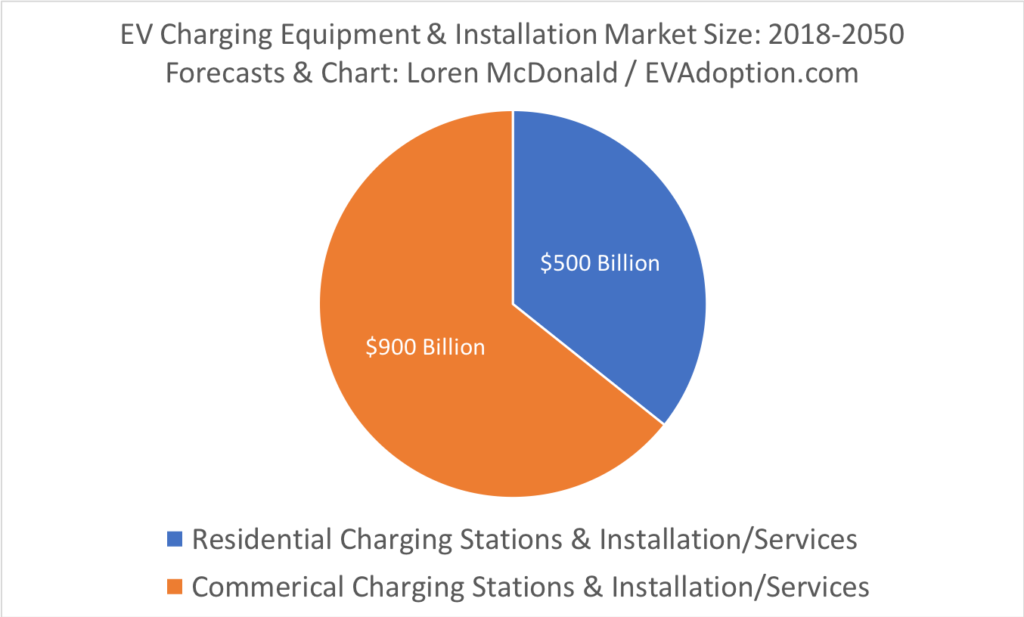

Residential EV charging stations have the potential to be one of the largest segments of the smart home product market and perhaps will be a bigger market than that for home energy management devices. In the long-haul these products and markets will likely merge or at least be complementary integrated products. I estimate that just the global residential consumer market for EV charging equipment, IoT/V2G and installation services will total $500 billion from 2018 to 2050.

The charging station installation services market will likely account for roughly 50% of that total as currently to install a Level 2 charging station in a home with various 220 electrical upgrades may cost as much or more than the charging equipment.

The EV charging market is currently in its infancy, but the global opportunity will likely become too large for major technology companies such as Google, Apple and Amazon to ignore. In fact, I will be surprised if in the next two or three years one or more of these companies does not enter into the residential EV charging equipment market.

Before looking at how these three individual companies may play in the EV charging market, let’s look at some of the key synergies and reasons why the EV charging equipment and services market is a likely natural progression for these tech giants:

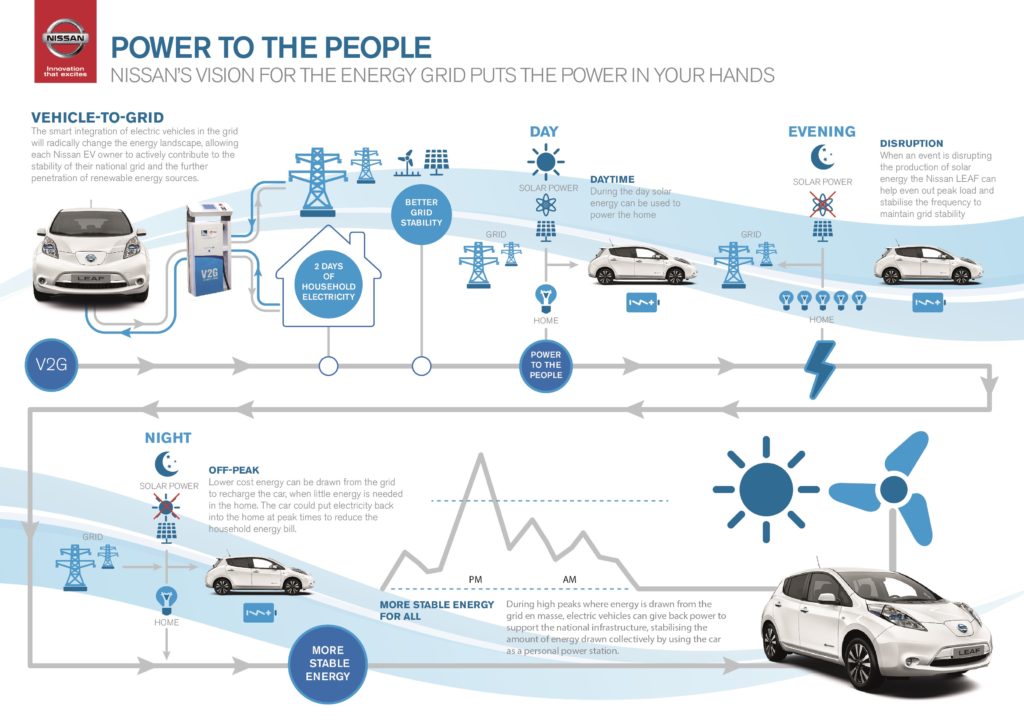

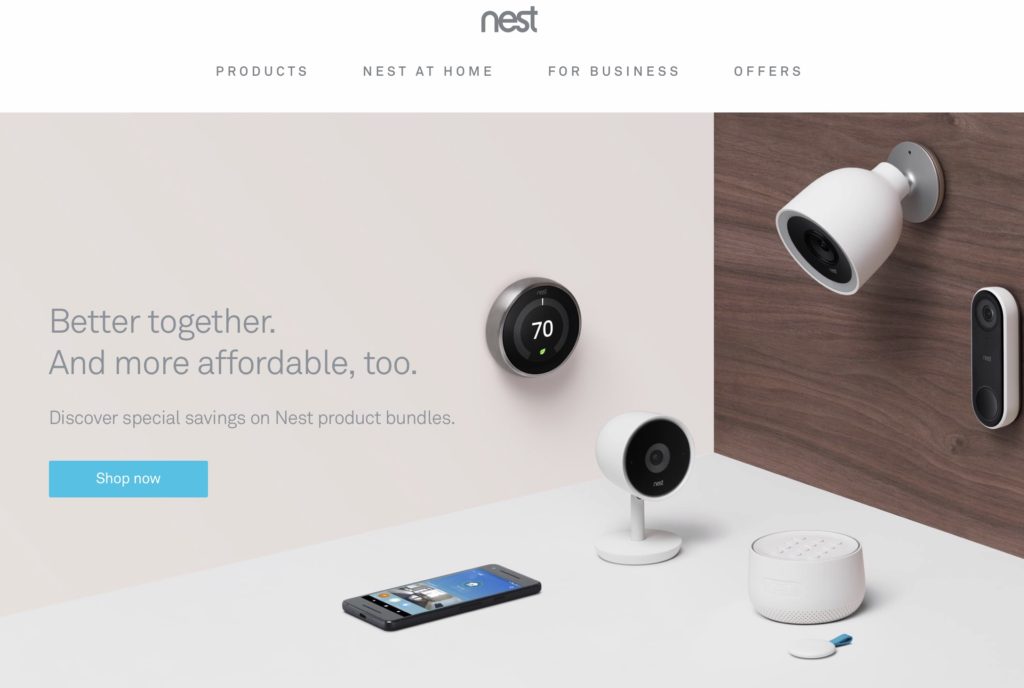

AI/Machine Learning: All three companies are leaders in the development of AI and machine learning-based products and solutions. Smart chargers of the future, especially those with demand response and vehicle to grid (V2G)/vehicle to home (V2H) functionality will use machine learning and AI capabilities to learn and make decisions on when to charge versus sending electricity to the grid or the home. Companies such as eMotorWerks, CrowdCharge and Fermata Energy will increasingly rely on AI and machine learning to power their V2G solutions. Could Google with its Nest platform follow suit?

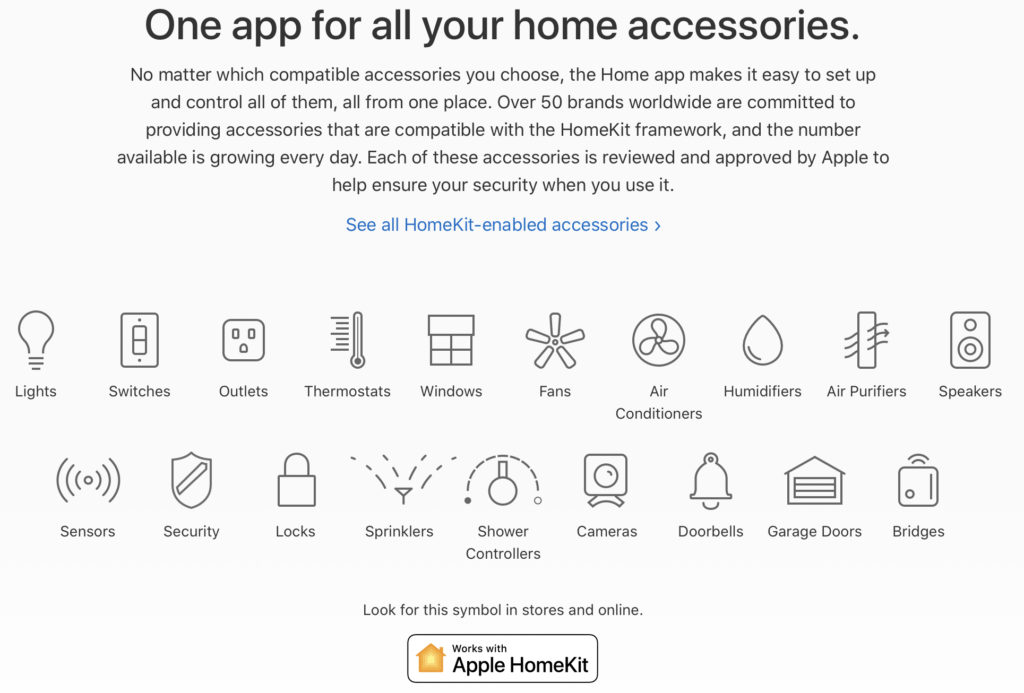

Smart Home Products: All three companies have entered this space, either directly (Google Nest and Amazon Cloud Cam, Echo), or indirectly through Apple’s HomeKit. EV charging stations are simply another product line in this overall category.

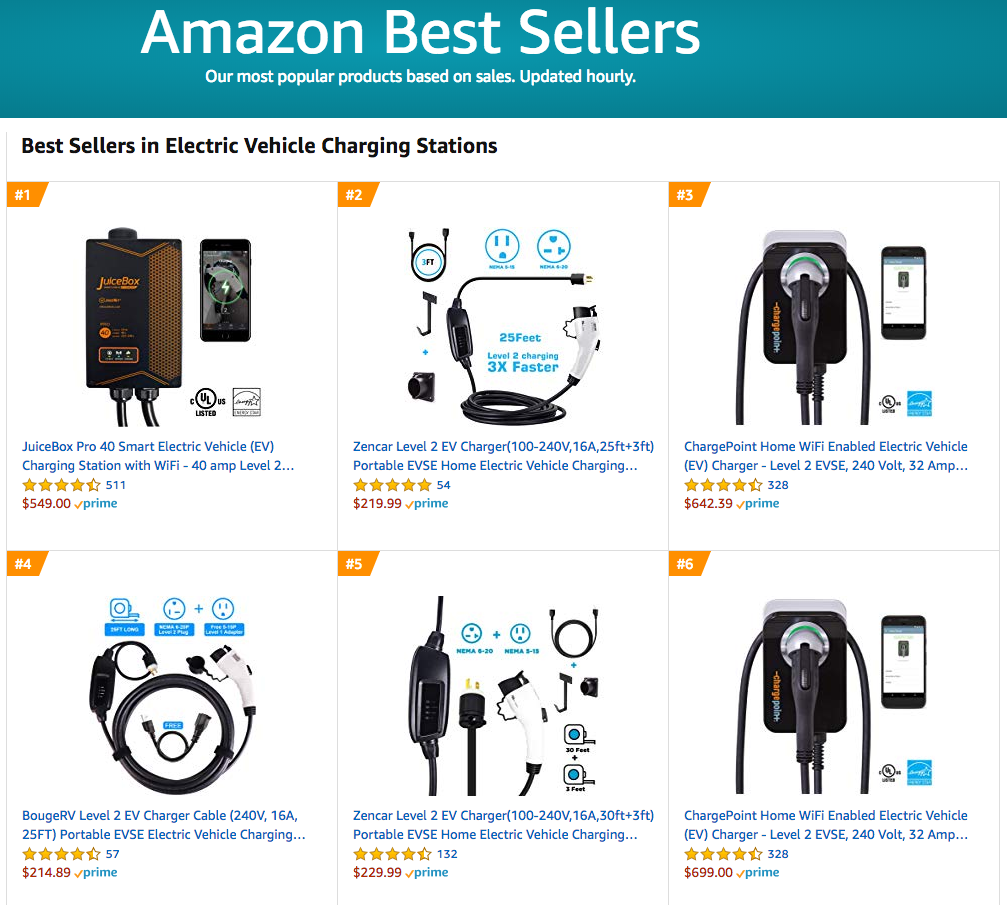

Ecommerce: Amazon is presumably already the leading online seller of EV charging stations. If they choose to enter the space, the Google Nest and the Apple websites would also become significant and dominant sales channels.

Retail: The Apple stores with their service and education approach and Genius Bar would provide an advantage over Google, Amazon and other online sellers.

Voice Assistants: All three offer AI-based voice assistants (Google Assistant, Apple Siri, Amazon Alexa). In fact, ChargePoint has already made their residential charging stations Alexa enabled.

Ad Networks: While not a model for residential home charging stations, companies such as Volta Charging offer free charging for customers who park and charge at their combo charging stations and “billboards” which feature ads to drive foot traffic to stores, museums, restaurants, etc. With its Google Ad networks, Google could decide to enter this space as the EV charging billboards would be just another advertising platform. They also may simply partner with companies such as Volta to provide the ad-based bidding system.I

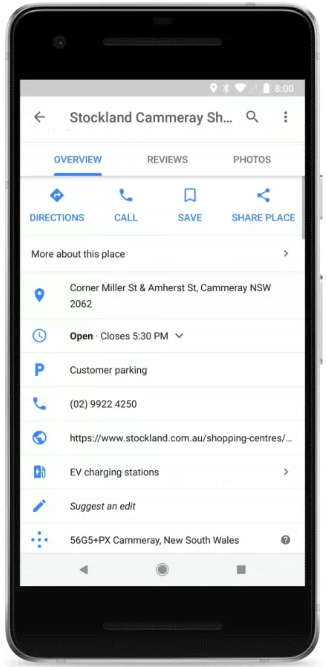

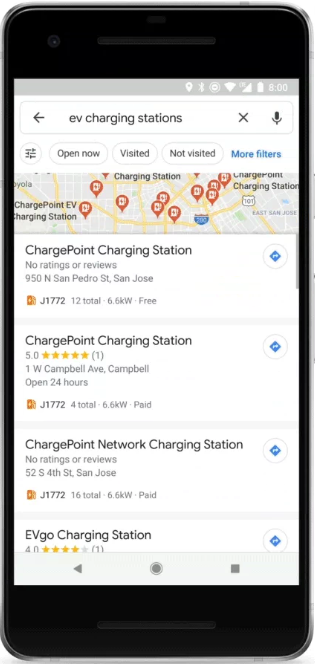

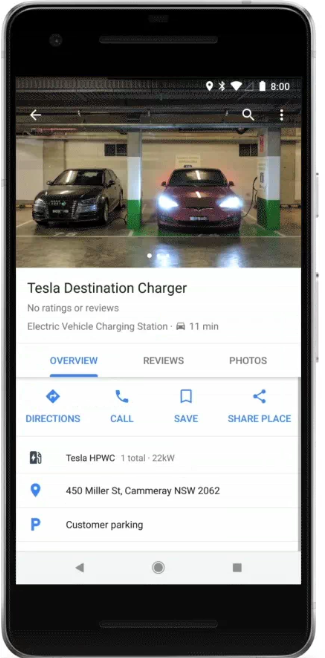

Mapping Software/Apps: Both Google and Apple have mapping software and apps that will increasingly guide EV drivers on where to stop and charge. In October, Google added EV charging station locations to its Google Maps. Google also acquired Waze in 2018 adding a social component which could lead to real-time station location information from drivers on the availability of chargers, how long waits are, which nearby restaurants to eat at, etc.

Additionally, owners of restaurants and retail shops might bid to show sponsored ads next to specific charging station locations and offer discounts or free charging with purchases.

Information/Data Services: While consumer data protection laws and a decreasing willingness among consumers to opt-in or share their data will limit usage, EV charging behavior, trip planning and location data provide a rich set of behavioral marketing opportunities. If Google knows your trip plans based on the destination you’ve input into Google Maps, it might suggest you stop to charge at a specific outlet mall and recommend a certain restaurant over charging stations located at a nearby Target or municipal parking lot.

And while this type of data usage might seem intrusive, you might also find recommendations from Siri, Alexa or the Google Assistant when it leverages network charging activity to proactively tell you that the charging speed is faster and there is no wait time at one charging location versus one a few miles while that has all chargers in use.

The answer in how tech companies use this data will likely result from a combination of the above use cases. If you as a consumer see value in being informed where you can have a quicker and better charging experience, you might in exchange opt in to being served ads and sponsored recommendations of businesses to visit.

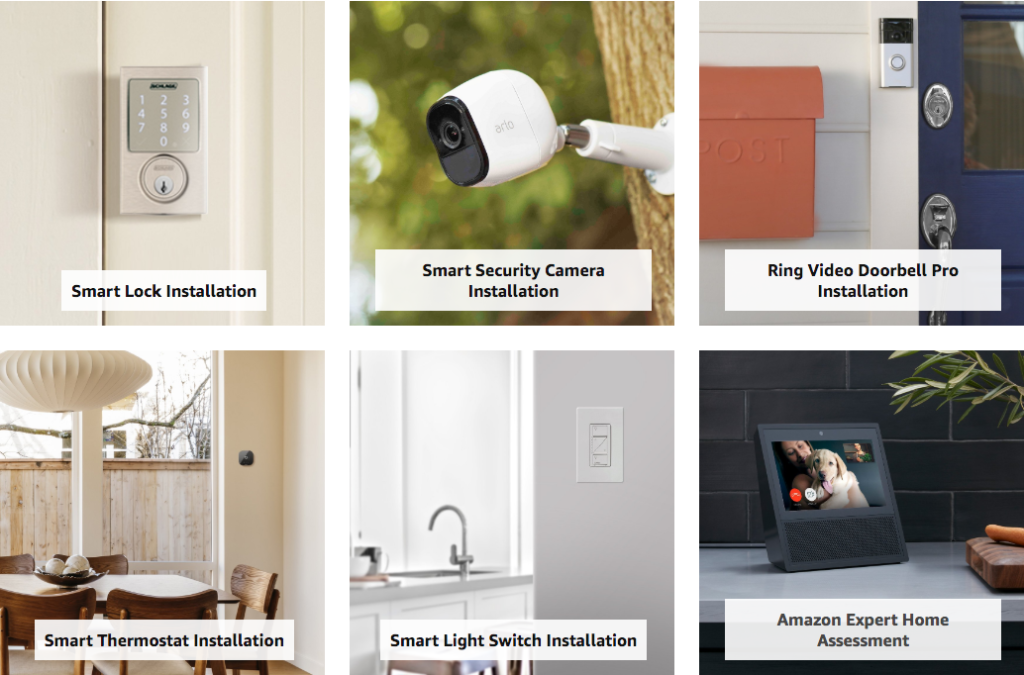

Home Technology Installation Services: Amazon has already entered the home technology services market though its Amazon Home Services offering and will eventually compete with Geek Squad and others for EV charging station installations.

Autonomous Vehicles: Alphabet’s Waymo (sister company to Google) autonomous vehicle division is felt by many experts to have the most advanced AV technology. Apple is rumored to be working on AV technology but apparently is no longer developing an actual electric vehicle. Most AVs will eventually be electric and need controlled locations to charge and so Google/Alphabet and Apple if it enters the AV space, will need to either partner with charging networks or acquire or build out their own to ensure an optimum and efficient charging experience for fleets of robotaxis.

Google’s Nest Platform Could Be a Game Changer

The play for Google is obvious, to be part of and extend the line of its Nest smart home products. EV charging stations in the future will all be internet connected (IoT – Internet of Things enabled), powered by AI and be integrated into utility demand response and vehicle to home (V2H/V2G) energy management programs.

As suggested above, the other key play for Google is to sell ads and prominent placement in its Google and Waze apps as well as charging station billboards.

Will Apple Wise Up and Take Advantage of the EV Charging Opportunity?

Apple recently has been falling behind competitors on several fronts including home assistants and smart home products. So while a bit more of a product leap, the EV charging station market would make perfect sense for Apple.

An Apple EV charger that is beautiful, easy to use and can be controlled by your Apple Watch, iPhone or iPad and voice interaction with Siri is just a no brainer. On the other hand, Apple seems to have decided to not produce smart home products, but rather provide a simple app-based system to manage them via its HomeKit framework.

Apple may want to reconsider this strategy, however, as hundreds of millions of Apple households worldwide may be more than willing to extend their Apple brand, iOS and product loyalty into their garages.

Amazon: Will The Company Expand Beyond Installation Services, Ecommerce and Alexa Integration?

I don’t expect Amazon to be left out of the EV charging market either. In fact, the ecommerce behemoth already has become a key player in the market and presumably sells more charging stations online than anyone else.

The company has also partnered with Audi for EV charging installation services through its Amazon Home Services offering and several automakers are integrating Alexa into their cars’ infotainment systems. The Alexa integration could ultimately be the conduit for an AI and voice activated smart charging and vehicle to home (V2H) system.

For now it appears that Amazon is well positioned to become the largest seller and installer of residential EV charging stations in most major regions of the world, except perhaps China and India. And while the company could eventually decide to develop its own line of charging stations as part of a growing portfolio of smart home products, it may decide to just be the dominant seller and installer and enable other equipment makers to power their charging stations with Alexa and Amazon Web Services.

What do you think? Will these major technology companies jump on the EV opportunity or leave it mostly to others? And what other tech companies may I have ignored such as Microsoft, Cisco and others?