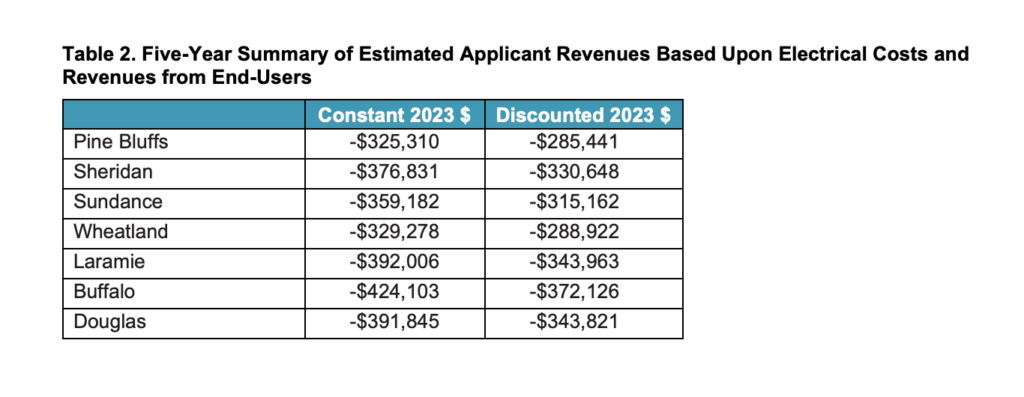

Analysis by a consulting firm retained by Wyoming Department of Transportation (WYDOT) suggests that companies successfully winning National Electric Vehicle Infrastructure (NEVI) grants for 7 remote Alternative Fuel Corridor (AFC) sites in the state would lose from $285,000 to $372,000 per site over the 5-year NEVI award period.

WYDOT has hired a consultant, HDR, Inc., to write the technical specifications for the NEVI RFP. HDR completed studies regarding EV charging station economic return on investment and EV use estimates. Although HDR used different methodologies to complete the studies, findings are similar to WYDOT’s analyses regarding potential challenges the NEVI program’s EV charging infrastructure may have in our state.

Quote from WYDOT NEVI website

Analysis by HDR, Inc. for WYDOT has the remote 7 sites seeing only from 1 to a maximum of 3 charging sessions per DCFC per day, per site. This low-level of utilization may or may not turn out to be true, but one apparent flaw in the analysis is the number of charging sessions staying static over the 5-year period. In general, the average number of sessions per charger at many DCFCs in the US roughly doubled in 2022 from 2021. So while these Wyoming AFC sites will likely be huge money losers, WYDOT and its consultant may be underestimating the likely continued growth in DC fast charger utilization — even in remote areas of Wyoming.

Another element seemingly ignored in this analysis is that similar to the opening of gas stations in remote areas, the addition of DC fast chargers can serve as “honeypots” attracting EV drivers to explore these routes. In other words, road trips in an EV can be akin to the chicken and the egg concept, in this case if a highway sees the addition of multiple DC fast chargers it will attract EV drivers who typically love to explore new routes in their EVs.

WYDOT has been arguing since day one of the NEVI planning process coordinated by the Federal Highway Administration (FHWA) that companies will not apply to the state because the sites do not make economic sense. WYDOT actually asked for 11 AFC location exceptions and were denied for eight of them by FHWA. This will continue to be interesting to watch as WYDOT has been almost confrontational with FHWA since day one about the NEVI sites and program for their state.

But WYDOT has a legitimate argument as even with higher utilization, these remote highway sites in states such as Wyoming, North Dakota, South Dakota, Montana, Idaho, and others are not likely to break even for perhaps ten years due to the combination of higher energy and infrastructure costs and lower utilization versus heavily trafficked highways. Perhaps a significant flaw in the FHWA NEVI formula program is not taking into account that many rural and remote locations have little to no chance of breaking even in five years, even with 80 percent of the costs covered by NEVI grants. While likely too late for the program to be revised, the NEVI formula should have taken lower utilization into account for the very remote highway locations.

This will continue to be interesting to watch as WYDOT has been almost confrontational with FHWA since day one about the NEVI sites and program for their state.