The race is on in the US to build out the necessary charging infrastructure to support an expected 45-50 million electric vehicles (EVs) on the road in the US by the end of 2030. Up for debate, however, is how many Level 2 and DC fast chargers will actually be needed to support this huge growth in EVs.

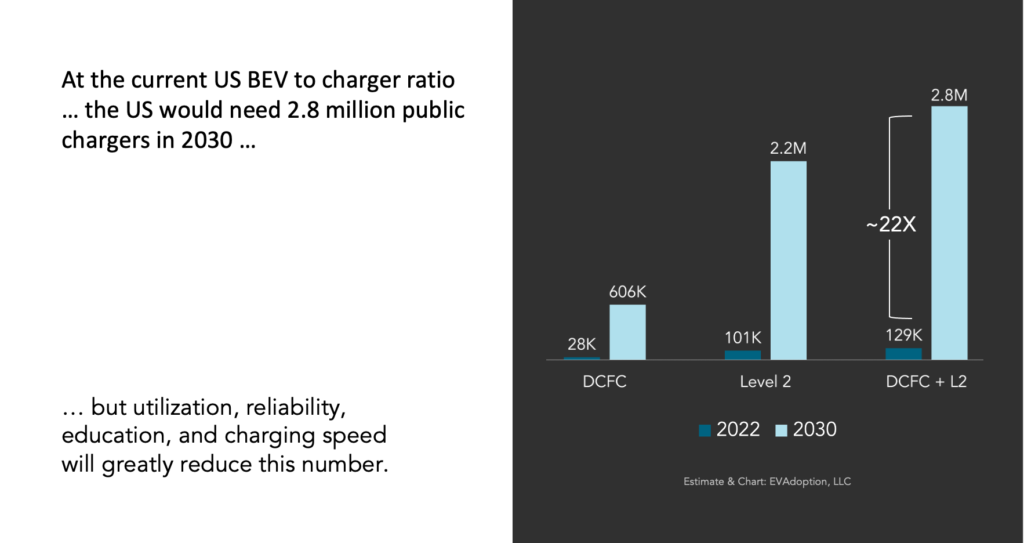

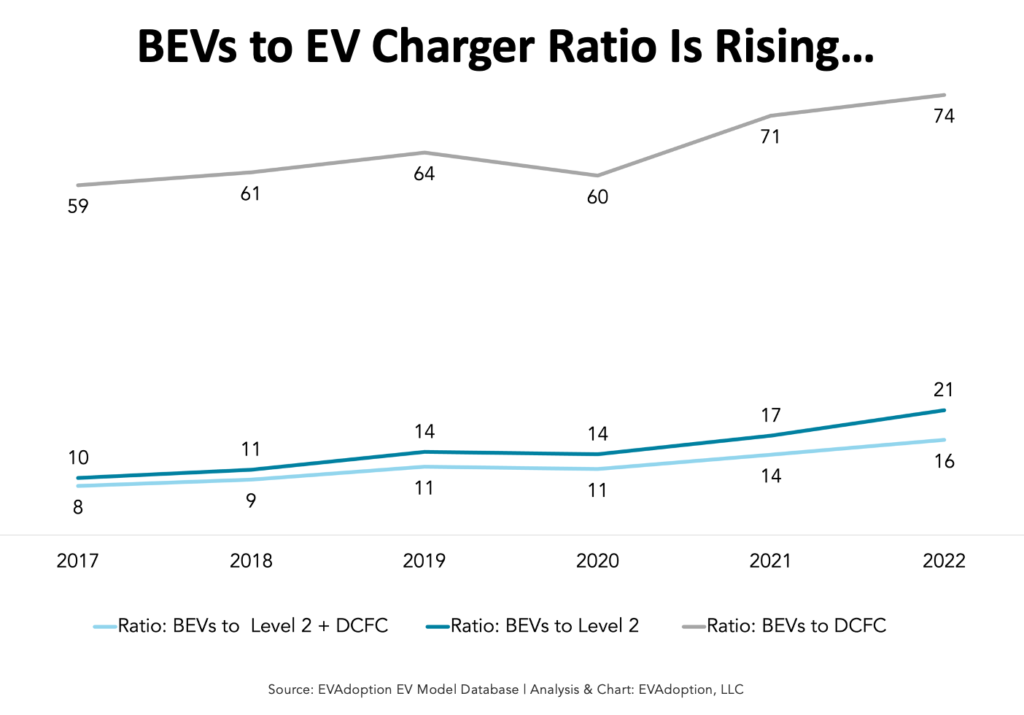

In my May 19 state of the industry keynote presentation at the Electrify Expo Industry Day in Long Beach, I shared a simple calculation based on the current ratio of BEVs (excluding PHEVs) to chargers. At roughly 16 EVs to every Level 2 and DC fast charger deployed in the US at the end of 2022, the US would need roughly 2.8 million public chargers at the end of 2030.

22 Times as Many Chargers Needed in 2030 as 2022?

Wow. That is a lot of charging infrastructure to be added, in fact, 22 times the number of installed public chargers at the end of 2022. But is that really about how many chargers the US will need to add in the next 7.5 years?

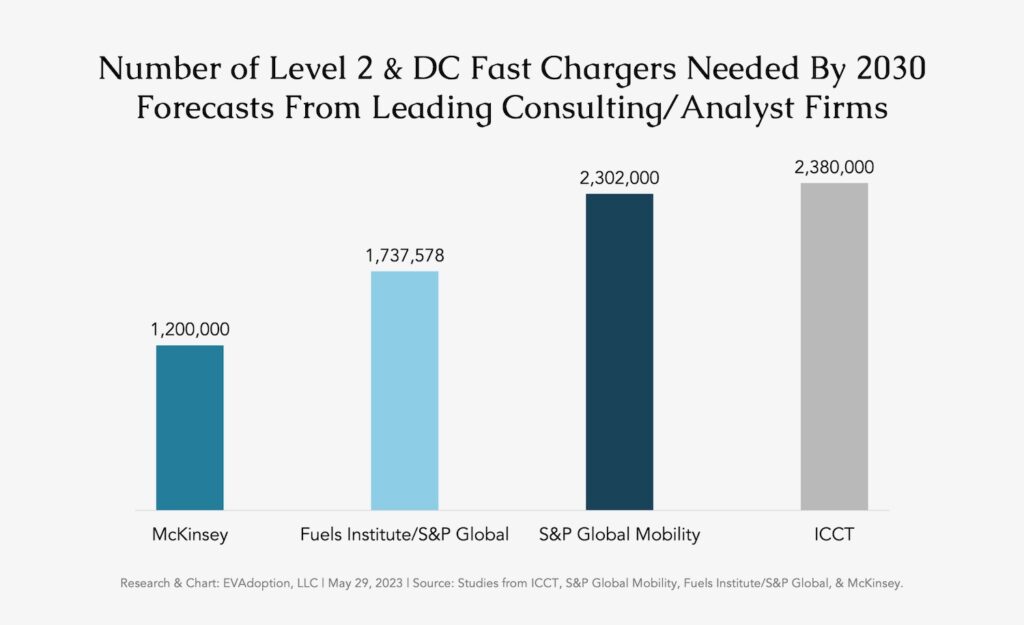

A quick Google search and you find several forecasts from leading analyst and consulting firms that are in the general neighborhood of my simple ratio-based calculation. In fact, most of the projections below are based on less than 30 million BEVs on the road versus our (EVAdoption’s) forecast of nearly 50 million. So using their ratios of EVs to chargers, most of them would likely be north of 3 million, except for McKinsey which used 44 million for its 2030 passenger vehicle forecast.

$300 Billion to Build Out EV Charging Infrastructure by 2030

Doing simple math, it would cost about $68.4 billion to deploy all of these public chargers. Let’s use the S&P Global Mobility forecast and EVAdoption cost estimates:

- Level 2: 2,130,000 X $20,000 = $42.6 billion

- DCFC: 172,000 X $150,000 = $25.8 billion

- Total: $68.4 billion

Now, this estimate also does not include private chargers such as those located at office buildings and apartment complexes that are only available to employees and tenants respectively. If we estimate a combined 10 million Level 2 chargers, we are looking at another $200 billion. And then add the cost of home Level 1 and Level 2 chargers and perhaps another $40 billion. Add that all up and the US is looking at potentially north of $300 billion in costs to build out EV charging infrastructure.

Factors Affecting the Number of EV Chargers Needed

In future articles, we will do deep dives on how many chargers we at EVAdoption think will be required, plus all of the factors that will determine how many are actually needed. The following, however, is a high-level overview of the key factors that will have a significant impact on the number of chargers needed:

Electric vehicles: The number of EVs on the road is of course the foundation of how many public chargers are needed, but there are still several key variables beyond a sheer number of vehicles, including:

- Electric vehicles in operation (VIO): The more new EVs purchased or leased lead to more total EVs on the road. As the sales share of new vehicles purchased increases each year, the total number of EVs increases significantly, and often at a much faster rate than the relative number of public EV chargers added.

- Mix of BEVs versus PHEVs: If PHEVs regain popularity and see an increase in the share of new vehicle sales, this trend would reduce the number of DC fast chargers needed and have only a modest impact on Level 2 chargers.

- Battery size and range: Larger batteries and longer range mean that BEV drivers on road trips do not need to stop as often to charge. But when they do stop, they may need to charge for longer periods unless they optimize for their EV’s charging curve.

- 800 volt versus 400 volt systems: EVs with 800 volt systems can charge at higher speeds and tend to have faster charging curves — adding up to shorter charging sessions and fewer (albeit more expensive) needed higher-powered DC fast chargers.

- Maximum charging capability: Many BEVs available in the US today can only charge up to a maximum of 100 kW to 150 kW. As a higher percentage of future BEVs are able to charge at speeds north of 250 kW, charging sessions can be shorter, reducing the number of DC fast chargers needed.

- Smart navigation: As in-car navigation systems get smarter and smarter, they will route EV drivers to chargers that best meet the driver’s preferences, have the fastest chargers, shortest wait times, best customer experience, and nearby amenities — all leading to better system-wide optimization and utilization.

EV Chargers: EV chargers, whether Level 1, Level 2, or DC fast chargers are of course a key variable in how many more chargers are needed in the US. The more high-power, reliable, and strategically located they are — the more charging sessions they can serve.

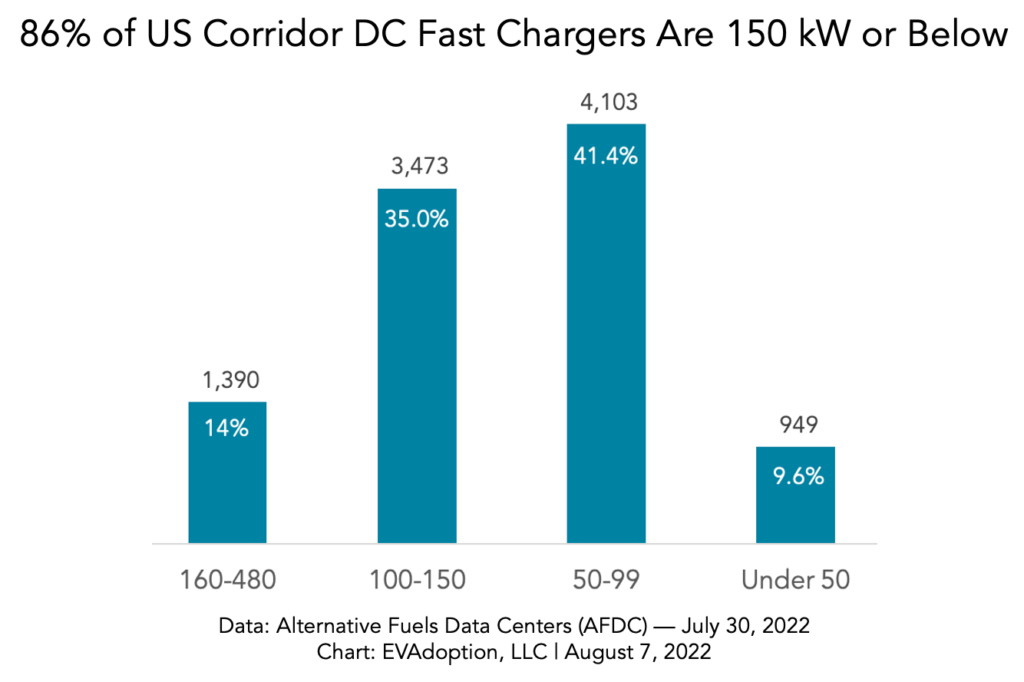

- Faster chargers: As high-power DC fast chargers of 350 kW and even higher become more ubiquitous in the future, it will reduce charging times from the current large percentage of 62 kW and 150 kW DC fast chargers at public charging stations.

- More reliable chargers: A charging station with 4 DC fast chargers, but one of them being offline is a 25% reduction in availability. One of the biggest issues currently, as uptime increases, more drivers will be able to charge simultaneously.

- Plug and Charge: As more EVs and EV chargers are Plug and Charge compatible, there will be fewer issues getting a charging session started, leading to potentially an additional session being available each day at a charger.

- More chargers per charging station (site): Tesla has led the way with now an average of about 11 DC fast chargers per Supercharger location, but with many sites having 16, 20, or more Superchargers. The benefit of this higher ratio of chargers per site is that every few minutes a driver is done charging — so even if there is a wait — it may be less than 5 minutes. When there are say only 4 or 6 DCFCs per site, it might be 10-20 minutes before a charger opens up.

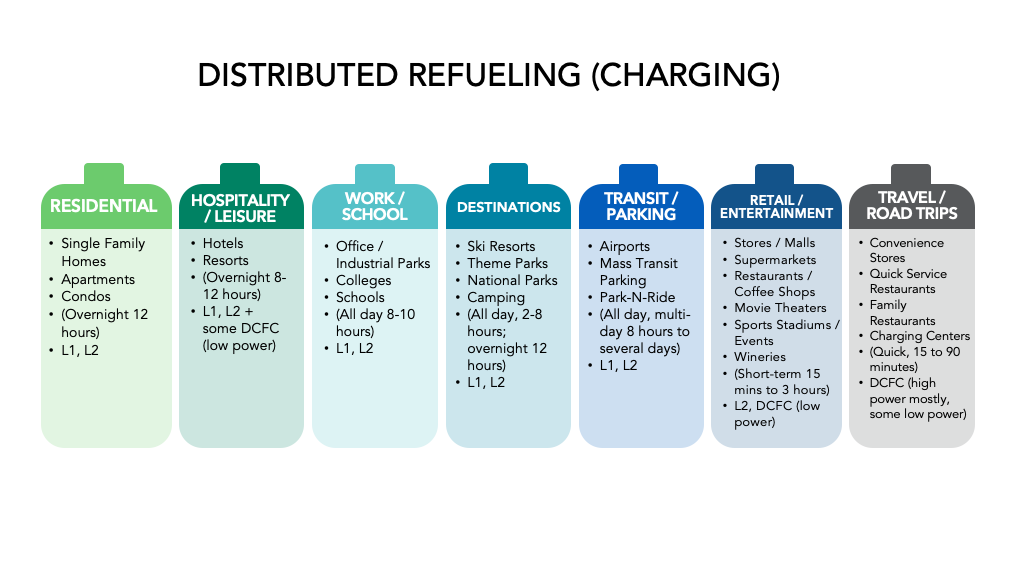

Deployment Types: In theory, public DC fast chargers should only be needed when drivers are on road trips of 200-500+ miles. As Level 2 charging is built out at the following location types, fewer DC fast chargers should be needed:

- Destination/Hotels: As more hotels, resorts, parks, campgrounds, theme parks, and other destinations add Level 2 chargers, travelers can rely less on DC fast charging in route. Depending on the range of your EV and the length of your trip, access to a charger upon arrival at your destination can mean needing to stop one less time at a DC fast charger. This combination of fast chargers on popular highway routes (Superchargers) and Level 2 chargers (Destination Charging) at hotels, resorts, wineries, etc. are part of Tesla’s huge advantage in ensuring EV driver charging confidence.

- Multifamily: Nearly 40 percent of US households live in apartments, townhouses, and condominiums. Unlike single-family homes where the homeowner controls their charging destiny, renters and condo-dwellers are subject to apartment condo homeowners associations’ decisions to invest in or allow chargers to be added.

- Workplace: For many EV drivers, the vast majority of their annual vehicle miles traveled (VMT) is from their trips to and from work. For EV drivers without convenient access to a charger where they live, workplace charging is a huge benefit and advantage, especially for those with longer commutes and driving shorter range BEVs or PHEVs. The more ubiquitous workplace charging becomes, the fewer times EV drivers will need to access public Level 2 and DC fast chargers during the work week.

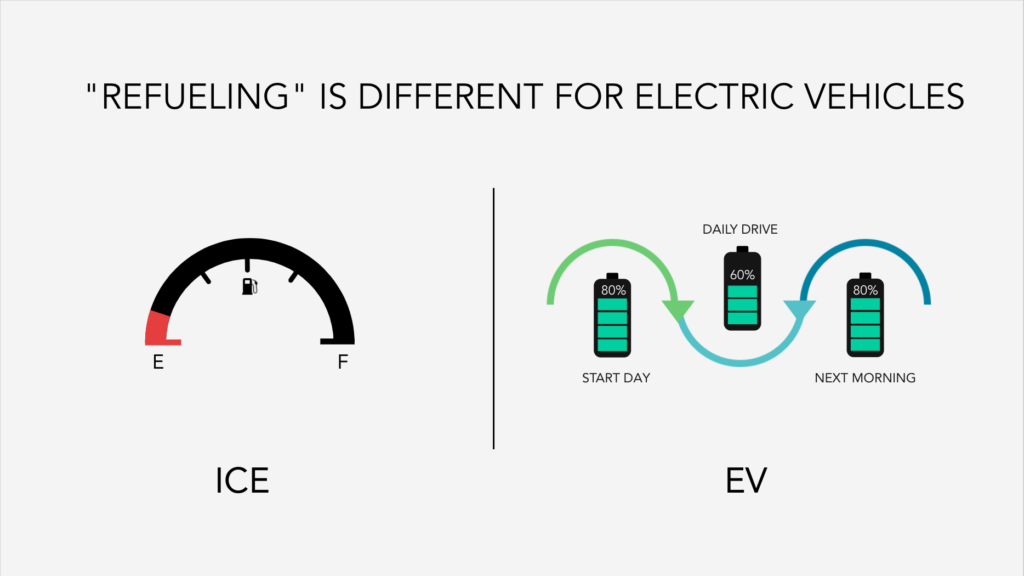

Consumer Education and Demographics: EV charging is not like refueling an internal combustion engine vehicle (ICE) at a gas station. Drivers of an ICE vehicle drive until their car or truck’s vehicle reaches near empty and they pull into a gas station, fill up their tank in 5-7 minutes, and head back out on the road. Refueling an EV, however, is more akin to how you charge a smartphone — which is when it is “parked.” Or as I like to say “charging is parking.” Unfortunately, many future and new EV drivers assume and expect that refueling an EV should be the same as an ICE vehicle. While at one level that is a reasonable expectation, it is a bit like expecting a smartphone to always be 100% charged because landline phones were always plugged in and “fully charged.” A few key variables include:

- Greater reliance on charging at “home”: I have a neighbor with a 3-car garage, who is upper income, and can easily afford to install a Level 2 charger (I even offered to sell him an extra Tesla Wall Connector). But he for some unknown reason charges at a Tesla Supercharger near his office (no he doesn’t have free charging). He is paying more per kWh, wasting time, going out of his way, and adding extra wear to his car’s battery. I don’t know what percentage of EV drivers who COULD charge at home but over-rely on public charging, but even if it is a relatively small percentage, that could mean the availability of 1-2 more charging sessions for EV drivers who NEED to use a public charger. And as more apartments and workplaces add EV chargers, these drivers will have more options than public chargers.

- Education and experience: Charging an EV is not necessarily an intuitive process. There are terms, processes, and things such as how wind, cold weather, and speed affect the range and when you might need to stop and charge. Additionally, learning the idea of charging curves and that charging between 20% to 80% can reduce charge times, but may mean an additional stop on your road trip — optimum practices that are best learned through experience. It isn’t necessarily intuitive that your trip in an EV might actually be shorter in total duration by stopping to charge more often but for shorter charging sessions. As charging apps and in-car navigation get smarter and more EV drivers are experienced and aware, their habits may free up chargers, soon making them available to more drivers throughout the day.

- Evolving EV buyer demographics: A large percentage of early-adopting EV buyers have higher-than average household incomes, are more likely to live in a single-family home, have solar, and have the means to add an EV charger where they live. But is EV buyers become more mainstream, more of them will be renters, live in urban settings without garages, and be of lesser incomes and maybe living in older homes that require expensive upgrades for a Level 2 charger. The result being that as EV buyer demographics evolve a higher percentage of EV drivers may relay on access to charging at their apartment or condo, or need to access workplace or public charging.

There are literally dozens of factors that will affect how many public Level 2 and DC fast chargers are needed in the US in the coming years. Above are just some of them, but it is clear that simple current ratios of EVs to EV chargers while helpful, may not be a good indicator of how many chargers are needed in the future. We will dive further into this topic in future articles and likely offer our own EVAdoption forecast of needed chargers in 2030.