The Internal Revenue Service (IRS) recently released updated guidance on a tax credit for the installation of electric vehicle (EV) charging stations. The guidance has implications for both consumers and commercial businesses, in this article we will focus just on the implications for commercial businesses and charge-point operators CPOs).

One significant change in the guidance is the expansion of the tax credit to include 2- and 3-wheelers, which were previously excluded. This opens up the credit to charging sites catering to motorcycles, e-bikes, and 3-wheeled “NEVs” (neighborhood EVs). While the market for motorcycles and 3-wheelers may still be limited, this credit could provide valuable assistance to dealers and small fleets interested in adopting these types of vehicles. It may also lead to the development of multi-mobility charging hubs, bringing together various forms of electric transportation.

Another notable change is the shift from applying the credit to the entirety of refueling equipment at a single site to applying it to each individual fast charger. This interpretation of the rule means that the credit can now be applied to every charger at a location, rather than being limited to the overall property. This change has the potential to increase the number of chargers at planned or existing sites, particularly those located in low-income or non-urban census tracts.

The IRS has also specified that the qualified alternative fuel vehicle refueling property must be placed in service in an eligible census tract, either a low-income community or a non-urban area. While this requirement aligns with the goal of directing charging infrastructure to areas that lack private industry investment, it may result in low utilization of chargers in these locations.

This is because low-income households usually purchase affordable used vehicles, for which there is currently a limited supply of EVs with a sufficient range available in the market. However, this requirement could drive an increase in the adoption of electric commercial vehicles in low-income areas, as many fleet yards, factories, and warehouses are located in these communities. And a potential niche area could be “mom and pop” gas stations in lower-income regions, such as on the way to airports and sports stadiums.

A huge need in the US is to build out charging infrastructure at multifamily properties, but I don’t see this credit affecting this market much because owners of apartments in low-income areas aren’t likely going to see the demand or need to install EV chargers, since none or few of the tenants likely drive EVs.

Lastly, the rural (non-urban) census tracts are also a significant chicken and egg issue. Rural households tend to be very pickup-truck centric and will be some of the last households and demographics to “go EV.” But they will generally live in single-family homes and can charge there, leaving their long-distance road trips as a potential hurdle to buy an EV.

The core NEVI corridor program is designed to help solve this “charging desert” issue, so we may see this credit be used in combination with NEVI funding. One of the biggest needs in rural areas is to attract visitors to destinations, so a growth area could be at places such as wineries, popular parks, and ski resorts. It is possibility that we might see some companies emerge with a business model to target these rural markets.

Will this guidance lead to a surge in new charging investments? It is unlikely to significantly increase the number of new sites, however, it may result in more chargers being installed at existing locations within these qualifying census tracts.

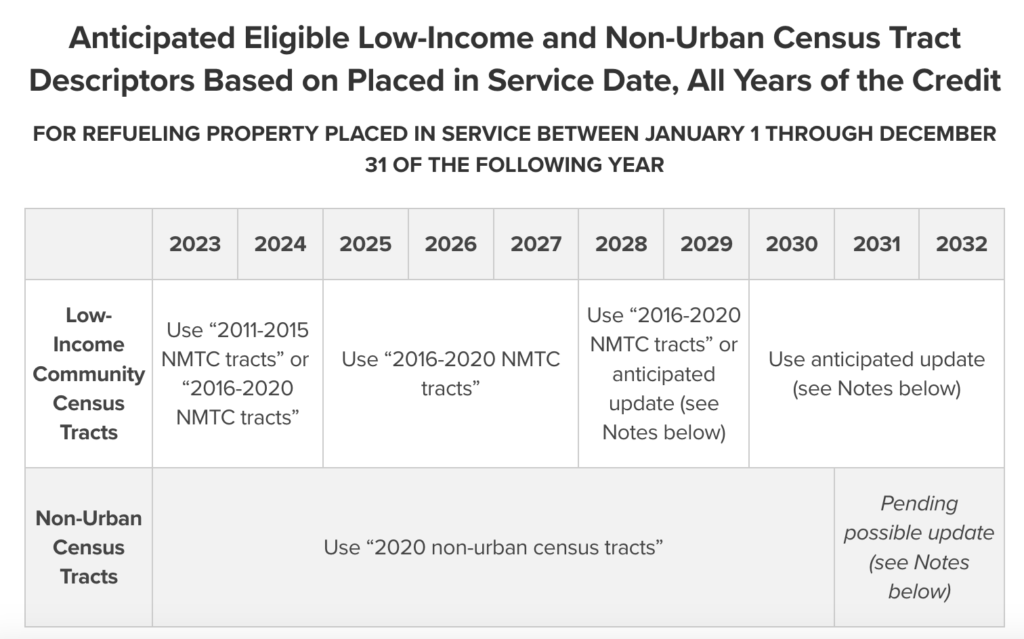

While the guidance clarifies the geographical requirements through maps, lists (See Appendix A and Appendix B), and FAQs, it is still complex and subject to changes over time. The IRS or another government entity may eventually create a user-friendly portal for determining location eligibility. However, despite the clarity provided by the guidance, some areas may still raise questions due to inconsistencies or potential flaws in how low-income or non-urban tracts are identified.

Overall, the new IRS guidance potentially expands opportunities for fleets and companies involved in the installation of EV charging infrastructure in low-income and rural areas. The inclusion of 2- and 3-wheelers, the shift in credit application to individual chargers, and the emphasis on low-income and non-urban areas all present potential avenues for companies able to expand existing deployments or enter new markets.

Resources:

- IRS Press Release

- IRS Guidance

- Census Tract Map

- Lists (See Appendix A and Appendix B)

- FAQs